38 how to determine coupon rate

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

How to determine coupon rate

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%.

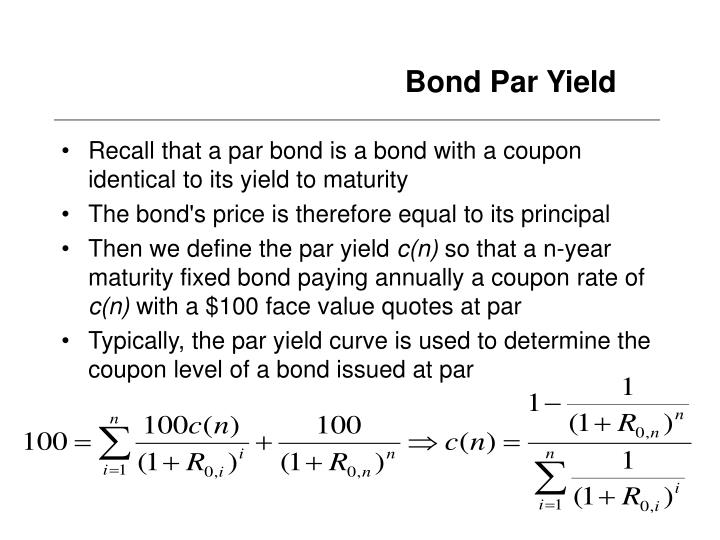

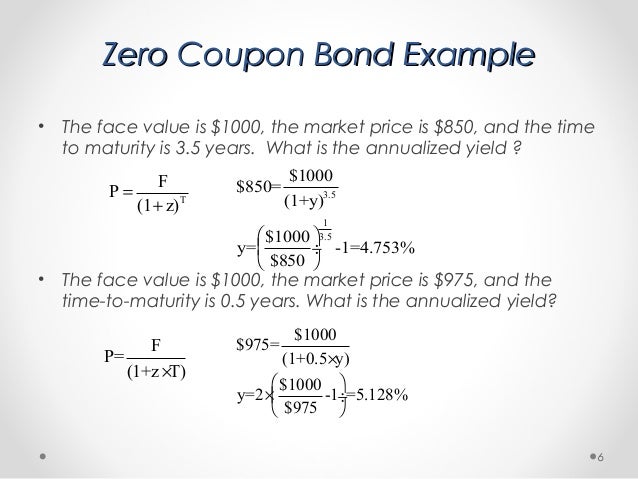

How to determine coupon rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! Bond Coupon Rate Calculator What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... How is coupon rate determined? - AskingLot.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. Click to see full answer. RATE Function - Formula, Examples, How to Use RATE Function Jun 07, 2022 · For a financial analyst, the RATE function can be useful to calculate the interest rate on zero coupon bonds. Formula =RATE(nper, pmt, pv, [fv], [type], [guess]) The RATE function uses the following arguments: Nper (required argument) – The total number of periods (months, quarters, years, etc.) over which the loan or investment is to be paid.

Present Value Formula | Step by Step Calculation of PV Let us take another example of a project having a life of 5 years with the following cash flow. Determine the present value of all the cash flows if the relevant discount rate is 6%. Cash flow for year 1: $400; Cash flow for year 2: $500; Cash flow for year 3 : $300; Cash flow for year 4: $600; Cash flow for year 5: $200; Given, Discount rate ... Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. Discount Rate Definition - Investopedia Aug 29, 2021 · Discount Rate: The discount rate is the interest rate charged to commercial banks and other depository institutions for loans received from the Federal Reserve's discount window.

2022 UPS Rate & Service Guide Determine the service that best meets your needs for domestic, export and import shipping. Also, learn about certain service restrictions that may apply. Section 2 PREPARING A SHIPMENT PAGES 10-26 Information about how you package a shipment, determine the rate and get the shipment to UPS is provided. Section 3 DETERMINING THE RATE PAGES 27-141 Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Coupon Rate Calculator | Bond Coupon 12/01/2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... How to Calculate Coupon Rate in Excel (3 Ideal Examples) The coupon rate is calculated by dividing the Annual Interest Rate by the Face Value of Bond. The result is then expressed as a percentage. So, we can write the formula as below: Coupon Rate= (Annual Interest Rate/Face Value of Bond)*100 3 Ideal Examples to Calculate Coupon Rate in Excel

Calculating the coupon rate - Free Math Help Forum I am stuck trying to figure out how to calculate the coupon rate. The examples I have found do not have it as an unknown. Please help! You don't need to use my numbers. I just want to know how to solve. Here's what is given: 14.5 years to maturity, semi-annual payments CURRENT price of the bond is $1038 YTM = 6.1% Question: what must be the ...

How to calculate Discount Rate with Examples - EDUCBA The formula for the discount rate can be derived by using the following steps: Step 1: Firstly, determine the value of the future cash flow under consideration. Step 2: Next, determine the present value of future cash flows. Step 3: Next, determine the number of years between the time of the future cash flow and the present day. It is denoted by n.

Coupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

What Is the Coupon Rate of a Bond? 18/11/2021 · A bond’s coupon rate is the fixed dollar value of the annual interest the bondholder will receive. It is stated as a percentage of the bond’s face value. The Balance Menu Go. ... The fixed dollar amount of interest can be used to determine the bond’s current yield, which will help show if this is a good investment for them. ...

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ...

What is Coupon Rate? Definition of ... - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

How to Find Coupon Rate of a Bond on Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator.

Discount Rate Definition - Investopedia 29/08/2021 · Discount Rate: The discount rate is the interest rate charged to commercial banks and other depository institutions for loans received from the Federal Reserve's discount window.

Post a Comment for "38 how to determine coupon rate"