42 relationship between coupon rate and ytm

Current Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · The YTM formula is a more complicated calculation that renders the total amount of return generated by a bond based on its par value, purchase price, duration, coupon rate, and the … Current yield - Wikipedia The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 ... Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), ...

Coupon Rate Calculator | Bond Coupon Jan 12, 2022 · For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued.. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same. Hence, a higher coupon rate bond, …

Relationship between coupon rate and ytm

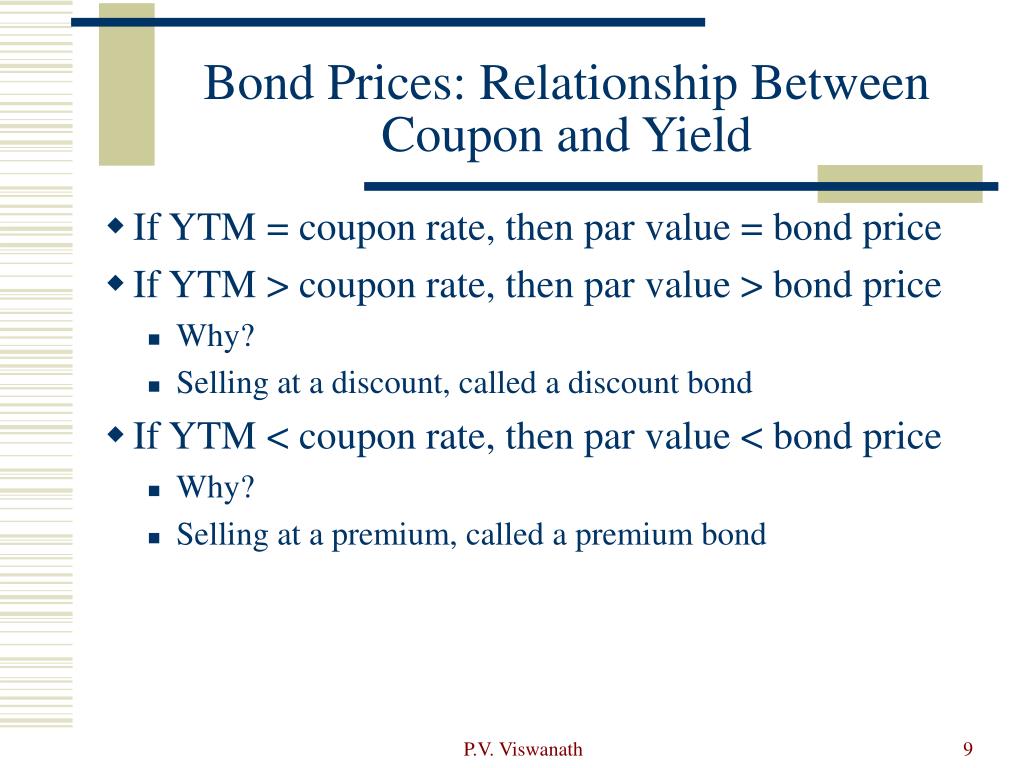

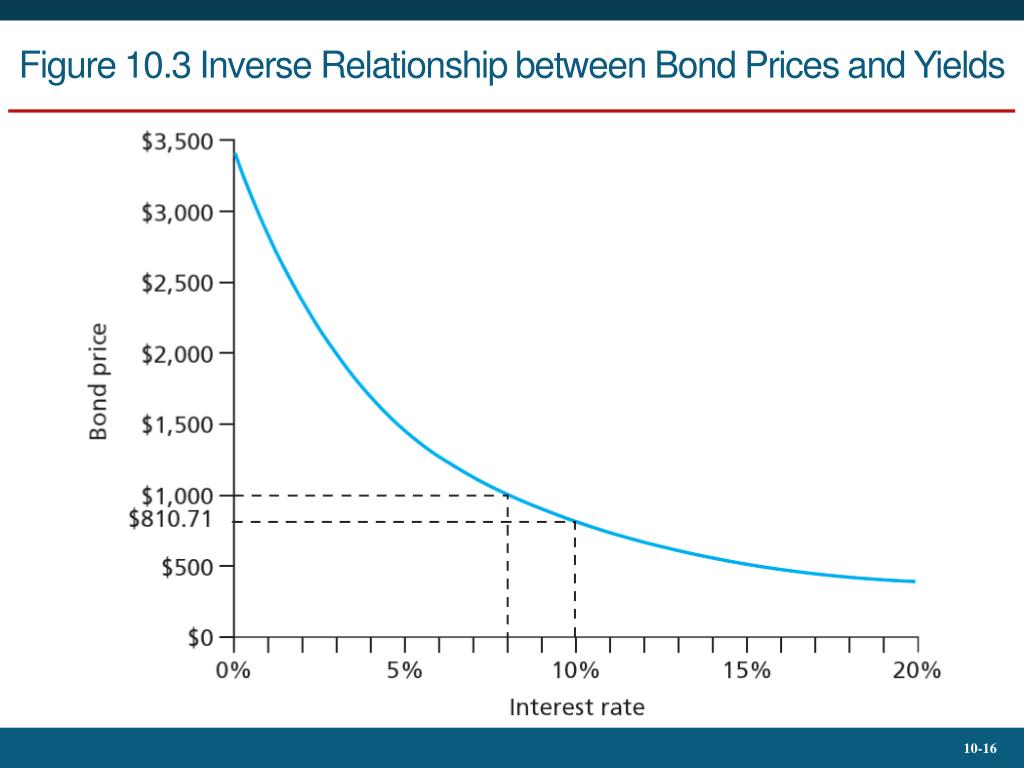

Relation Between Bond Price and Yield – Risk and Return Oct 04, 2016 · The relation between bond price and Yield to maturity (YTM) YTM is the total return anticipated on a bond if the bond is held until its lifetime. It is considered as a long-term bond yield but is expressed as an annual rate. Basically, YTM is the internal rate of return of an investment in the bond if the following two conditions are satisfied: › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM

Relationship between coupon rate and ytm. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It … How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Yield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity. ... , where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into the formula to solve for P, the ... › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond investments if you hold them until maturity, and so provides a more holistic picture of your return. The relationship between coupon rates and market interest rates › ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Dec 13, 2021 · The YTM formula is a more complicated calculation that renders the total amount of return generated by a bond based on its par value, purchase price, duration, coupon rate, and the power of ...

VALUATION (BONDS AND STOCK) - University of South Florida Therefore, the yield to maturity for this bond is 7.0 percent. Notice that the YTM, 7.0 percent, is much lower that the coupon rate of interest, 10 percent. This is because the The relationship between the coupon rate of interest and the market rate of interest, or yield to maturity, and the price of a bond will be discussed later. Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Where: Price+1%: Bond price when yield increases by 1% Price-1%: Bond price when yield decreases by 1% Price: Current trading price Δyield: Percentage point change in yield (note that it's squared; sign doesn't matter) But – stick with the better convexity formula if you have time to calculate it (or come back and visit this page!). › blog › relation-between-bondRelation Between Bond Price and Yield – Risk and Return Oct 04, 2016 · The relation between bond price and Yield to maturity (YTM) YTM is the total return anticipated on a bond if the bond is held until its lifetime. It is considered as a long-term bond yield but is expressed as an annual rate. Basically, YTM is the internal rate of return of an investment in the bond if the following two conditions are satisfied: financetrainingcourse.com › education › 2012How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond).

Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula › yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) – i.e. the discount rate which makes the present value (PV) of all the bond’s future cash flows equal to its current market price. Yield to Maturity (YTM) Formula How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · 3 mins read a. How to determine Forward Rates from Spot Rates. The relationship between spot and forward rates is given by the following equation: f t-1, 1 =(1+s t) t ÷ (1+s t-1) t-1-1. Where. s t is the t-period spot rate. f t-1,t is the forward rate applicable for the period (t-1,t). If the 1-year spot rate is 11.67% and the 2-year spot rate is 12% then the forward … en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Relationship between yield to maturity and coupon rate. The concept of current yield is closely related to other bond concepts, including yield to maturity (YTM), and coupon yield. When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

Relation Between Bond Price and Yield – Risk and Return Oct 04, 2016 · The relation between bond price and Yield to maturity (YTM) YTM is the total return anticipated on a bond if the bond is held until its lifetime. It is considered as a long-term bond yield but is expressed as an annual rate. Basically, YTM is the internal rate of return of an investment in the bond if the following two conditions are satisfied:

Post a Comment for "42 relationship between coupon rate and ytm"