43 coupon vs interest rate

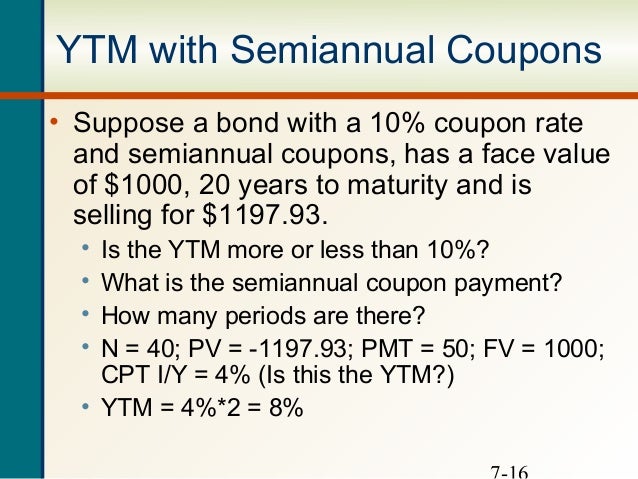

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

Coupon vs interest rate

Interest Rate Swap - Learn How Interest Rate Swaps Work An interest rate swap is a type of a derivative contract through which two counterparties agree to exchange one stream of future interest payments for another, based on a specified principal amount. In most cases, interest rate swaps include the exchange of a fixed interest rate for a floating rate. Similar to other types of swaps, interest ... Coupon Vs Interest Rate Coupon Vs Interest Rate . Coupon Vs Interest Rate, Clipdeals Com Calgary, Full Mattress Set Deals, Bagittoday Coupons June 2020, Burger King Coupons Canada Pdf, Lakeshore Coupons For Free Shipping, Evans Halshaw Ford Finance Deals ... Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser.

Coupon vs interest rate. Bond yield vs coupon rate: Why is RBI trying to keep yield down? For example, if the coupon rate of a 10-year bond of face value of Rs 1,000 is 6 per cent, it will pay interest of Rs 60 every year on each bond for the investment period of 10 years. On the other... Coupon Vs Interest Rate Coupon Vs Interest Rate . Coupon Vs Interest Rate, Coupon Code For E-wigs.com, Beautyjoint Coupons 2020, Denver Zoo Coupons July 2020, Downeast Basics Coupon Code Free Shipping, Mark's Work Wearhouse Coupon October 2019, Deals To Meals Blog ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Loan Interest vs Principal Payment Breakdown Calculator If you have a fixed-rate loan the amount paid each month is determined by the interest rate and the lenght of the loan. Lenders can look at the term of the loan and charge an interest rate which they feels compensates them for the risk of loss, the cost of inflation, their business overhead & their profit margin. With a fixed rate loan the amount of each payment stays the same across …

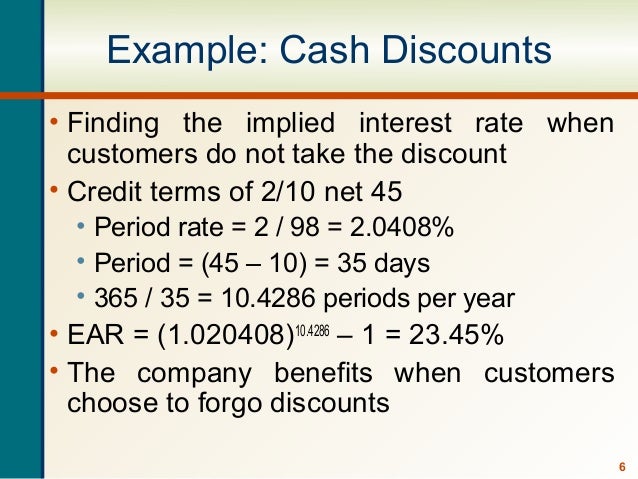

APY vs Interest Rate: What Is the Difference [Guide for 2022] When calculating the interest rate vs APY, you need to multiply by 100 and get to a percentage to find the interest rate. If you multiply 0.053660387 by 100, you find the interest rate equals 5.366% (if the APY is 5.5 %, and interest is compounded monthly). Why Online Savings Accounts Can Offer Higher Interest Rates ... Savings account interest rates are on the rise.But on a national scale, they're still extremely low: the most recent data shows the national average savings rate is just 0.08%.. But these types ... Discount Rate vs Interest Rate | 7 Best Difference (with … Here we also discuss the Discount Rate vs Interest Rate key differences with infographics and comparison table. You may also have a look at the following articles to learn more-FCFF vs FCFE ; Financial Lease vs Operating Lease; Book Value vs Market Value; Growth Stock vs Value Stock; All in One Financial Analyst Bundle (250+ Courses, 40+ Projects) 250+ Online Courses. … Discount Rate vs Interest Rate | Top 7 Differences (with … Discount Rate vs. Interest Rate Key Differences. The followings are the key differences between Discount Rate vs. Interest Rate: The use of discount rate is complex compared to the interest rate as the discount rate is used in discounted cash flow analysis for calculating the present value of future cash flows over a period of time, whereas the interest rate is generally charged by …

Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Understanding Interest Rate Swaps | PIMCO Interest rate swaps have become an integral part of the fixed income market. These derivative contracts, which typically exchange – or swap – fixed-rate interest payments for floating-rate interest payments, are an essential tool for investors who use them in an effort to hedge, speculate, and manage risk. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent. ARMs Offer Lower Mortgage Rates, but There's a Catch In response to rising mortgage rates, many of today's homebuyers have been turning to adjustable-rate mortgages, or ARMs. The share of ARM loans jumped from around 3% in early January to nearly 11 ...

Coupon Rate Vs Interest Rate - 30% Off Discount & Voucher Codes 2022 Coupon Rate Vs Interest Rate - 30% Off Discount & Voucher Codes 2022 Coupon Rate Vs Interest Rate 10% OFF Deal Additional 10% Off On Your Final Cart Value Get the best discount on almost everything using the latest 20% off Promo Code at checkout page. Time Is Running Out. 0 comments Report SHOW DEAL 20% OFF Deal You're Inivted!

Difference Between Coupon Rate and Required Return Difference Between Coupon Rate and Required Return (With Table) The rate of interest paid by the person who issues the bond based on the bond's face value is called the coupon rate. The periodic interest paid by the person who issues the bond to the buyer is called the coupon rate.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate … Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

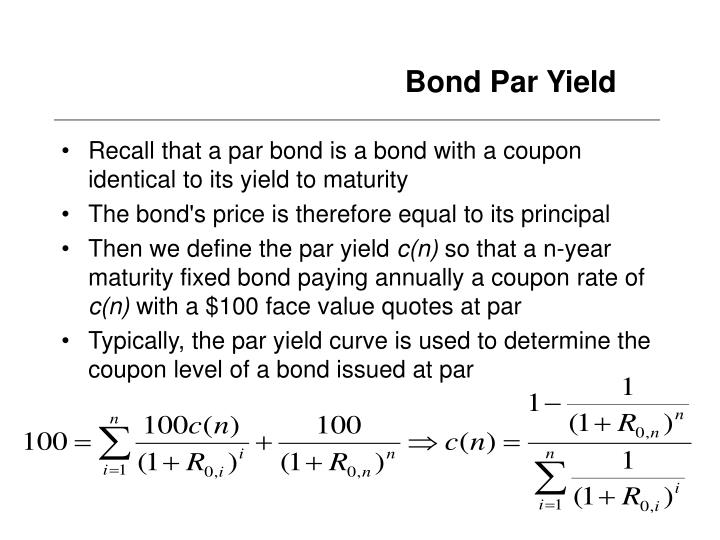

Coupon vs Yield | Top 5 Differences (with Infographics) Key Differences. For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield Calculation Of The Yield The Yield Function in Excel is an in-built financial function to determine the yield on security or bond that pays interest periodically. It calculates bond yield by using the bond's settlement value, maturity, rate, price, …

Difference Between Coupon Rate and Interest Rate In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender.

How are bond yields different from coupon rate? - The F The coupons are fixed; no matter what price the bond trades for, the interest payments always equal Rs 40 per year. The coupon rate is often different from the yield. A bond's yield is more ...

Yield to Maturity vs. Coupon Rate: What's the Difference? 20/05/2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

EPF Interest Rate History (Updated 2022) & Interest Calculation … 08/08/2019 · The latest EPF interest rate is 8.10% (the Financial year 2021-22) but the interest rates of the Employee Provident Fund have changed over the years as you clearly saw in the earlier section of this article about the EPF interest rate history in India. So it’s best that you make an informed decision about planning your retirement using EPF as savings. Related. …

Post a Comment for "43 coupon vs interest rate"