44 duration for zero coupon bond

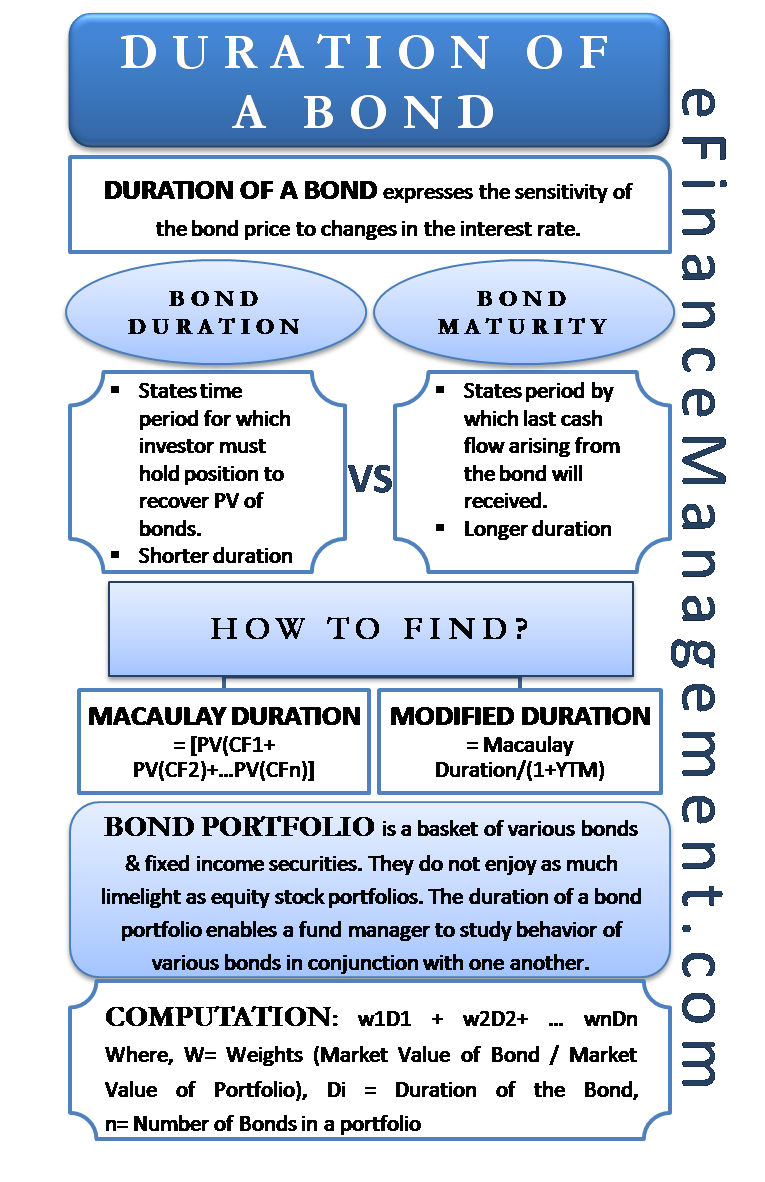

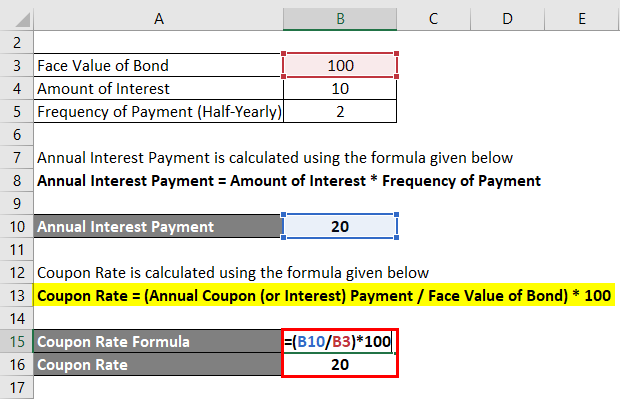

3 Short-Term Government Bond Funds for Portfolio Security Depending on the fund's definition, the short term can be up to five years. Mutual funds investing in government debt securities are among the most secure investment options that provide regular... Bond Key Terms (With Types and Methods of Investing) You can use this, the maturity and coupon rate to assess how much a bond is worth and compare it to other bonds. Coupon rate. The coupon rate of a bond is a fixed interest rate that bond issuers pay out to bond owners. For example, if a bond has a face value of $4000 and a coupon rate of 5% payable annually, then the bond issuer is promising to ...

India Government Bonds - Yields Curve 10 Years vs 2 Years bond spread is 93.6 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.90% (last modification in June 2022). The India credit rating is BBB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

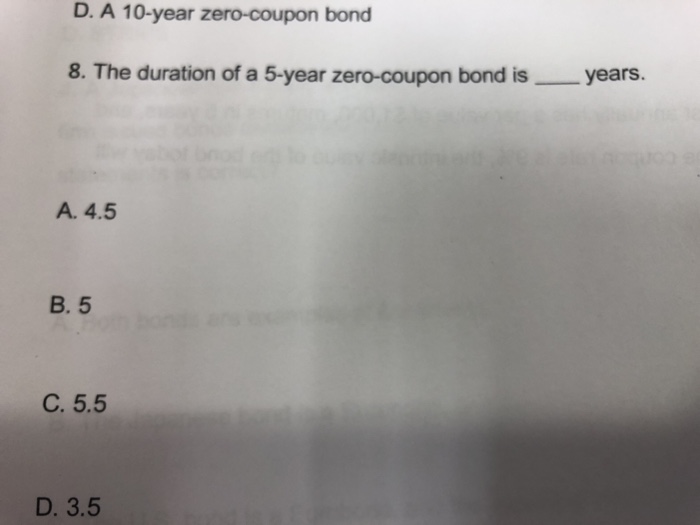

Duration for zero coupon bond

What is a Coupon Value? Definition and Calculation A zero-coupon rate bond does not pay an annual coupon rate It has longer maturity dates and greater volatility but sells for a discount An entity sells a 20-year zero-coupon rate bond at $5,000 The investor earns no interest during the 20 years but receives $30,000 at the maturity date What Are Bonds and How Do They Work? - The Balance Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ... Active, Index & Smart Beta Exchange Traded Funds (ETFs) | PIMCO The 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund was rated against the following numbers of Long Government funds over the following time periods: 1 stars out of 30 funds overall; 1 stars out of 30 funds in the last three years, 1 stars out of 27 funds in the last five years, and 1 star out of 21 funds in the last ten years.

Duration for zero coupon bond. What to Do When Your Savings Bond Reaches Maturity Series I savings bonds, commonly referred to as "I bonds," fully mature after 30 years. However, you can redeem them as early as one year after purchase. If you do redeem them early, you'll give up... Long Term Government Bond ETF List - ETF Database Long-term bonds generally have maturities longer than 10 years. Click on the tabs below to see more information on Long Term Government Bond ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. What Is a Zero Coupon Yield Curve? (with picture) The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. South Africa Government Bonds - Yields Curve 10 Years vs 2 Years bond spread is 413 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.75% (last modification in May 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 313.76 and implied probability of default is 5.23%.

Treasury Rates, Interest Rates, Yields - Barchart.com Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least risky investment available to U.S. investors. ... Often these loans are very short in duration. Managing the bank rate is a preferred method by ... What Is a Forward Rate? - The Balance A one-year zero-coupon bond earning 9%; A two-year zero-coupon bond earning 10%; You want to know what the one-year forward rate would be over the second year of the two-year bond. So you use this equation to figure it out. [ (1.10) 2 / (1.09) 1] - 1. 1.21 / 1.09 = 1.11 or 11%. Quant Bonds - Asset Swap Spread - BetterSolutions.com Uses the Zero Coupon Yield curve By combining the two you can change the coupon payments to either fixed or floating. This is the yield of the bond minus the swap rate for the corresponding maturity swap A fixed-rate bond will be combined with an interest rate swap in which the bond holder pays a fixed coupon and receives a floating coupon. Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields Municipal Market Yields The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022. AAA RATED MUNI BONDS

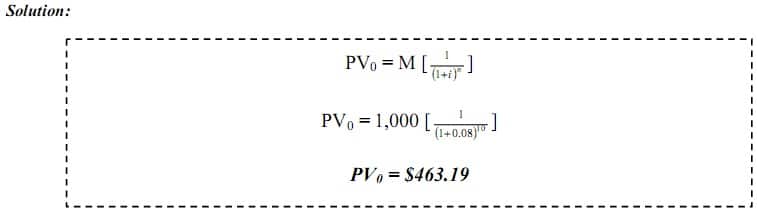

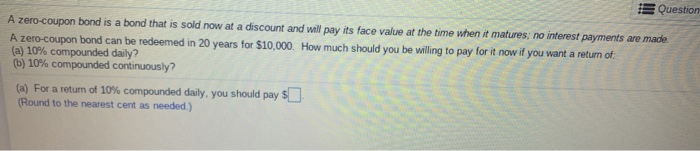

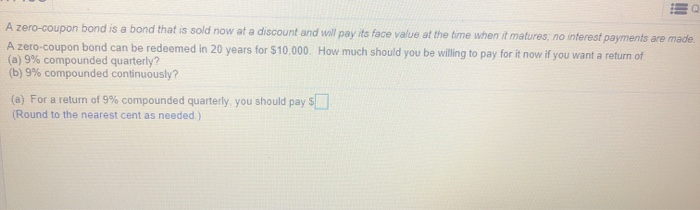

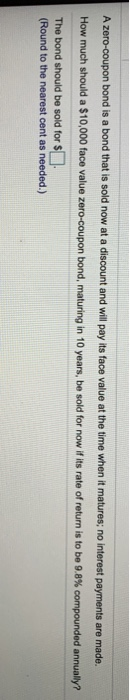

EDV - Vanguard Extended Duration Treasury Index Fund ETF Shares ... - CNN The advisor employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index. This index includes zero-coupon U.S.... What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able... EGP T-Bonds Zero Coupon Historical EGP T-Bills. USD T-Bills. EUR T-Bills. Treasury Auctions T-Bonds. EGP T-Bonds. EGP T-Bonds Zero Coupon. Deposits (OMO) Fixed Rate Deposits. Variable Rate Deposits. What Is Yield-To-Average Life? (with picture) The yield-to-average life calculates the expected yield of a fund by using the average number of years that a bond will be outstanding. By using the yield-to-average life, a bond investor can anticipate more accurately his return on a bond investment with a sinking fund requirement. For example, imagine a company issues bonds to raise $100,000 ...

Roll Bounce Coupon 45 coupon discount for myntra July 01, 2022 15% off Myntra Coupons, Promo Codes | June 2022 in Myntra coupons 5% OFF COUPON CODE Save 5% Off Take 5% Off on Flats and Flip-flops Purchase TW5 Show Coupon Code in Myntra coupons FREE DELIVERY PROMO Free delivery on all orders Get Free Shipping with your current myntra.com order.

Ministry of Finance plans to issue 28 T-bill, bond offerings worth EGP ... The plan also includes offering 4 Zero Coupon bonds, with terms of one and a half years worth EGP 29bn, two 3-year bond issuances worth EGP 7.5bn, and two 5-year bond offerings worth EGP 2bn.

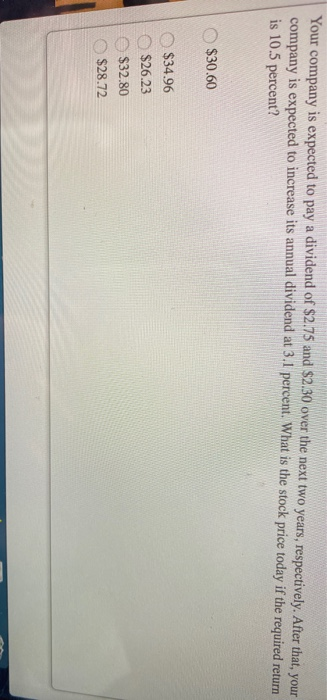

How To Find Bargains In Municipal Bond Funds - forbes.com If munis are yielding 3%, and if your state tax bracket is 8%, then all you can save by going double-tax-free is 0.24%. Therefore, the most you should be willing to pay for a single-state fund is ...

EDV Vanguard Extended Duration Treasury ETF - SeekingAlpha Vanguard World Fund - Vanguard Extended Duration Treasury ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. The fund invests in the fixed income markets of the United...

EDV | ETF Snapshot - Fidelity The advisor employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index. This index includes zero-coupon U.S. Treasury securities (Treasury STRIPS), which are backed by the full faith and credit of the U.S. government, with maturities ranging from 20 to 30 years.

Types of bonds — AccountingTools Zero Coupon Bond. No interest is paid on a zero coupon bond. Instead, investors buy the bonds at large discounts to their face values in order to earn an effective interest rate. Zero Coupon Convertible Bond. A zero coupon convertible bond allows investors to convert their bond holdings into the common stock of the issuer. This allows investors ...

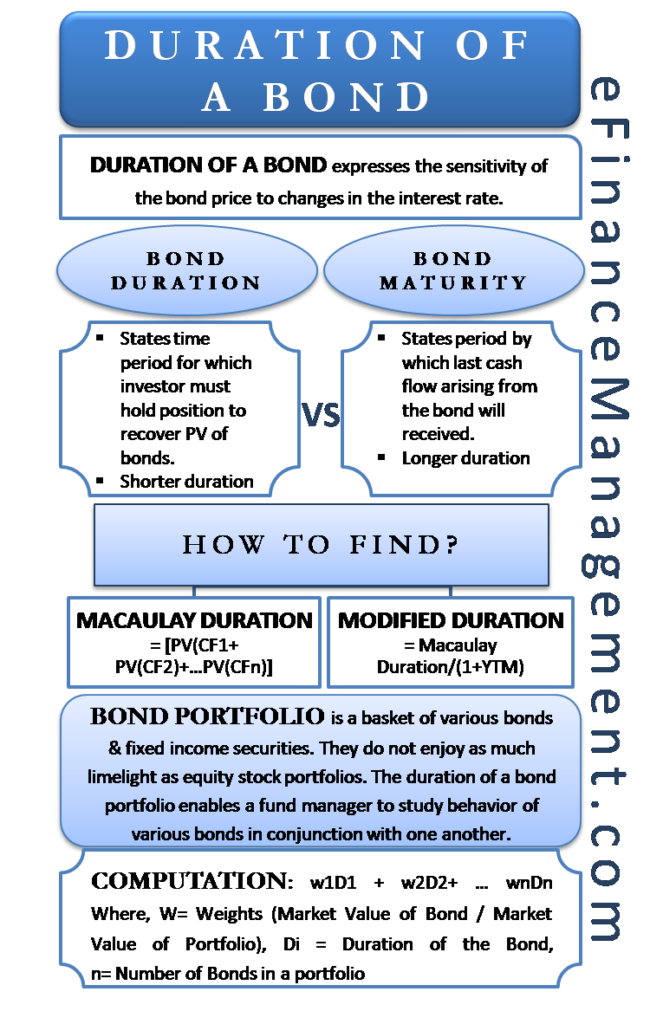

7 REIT Bear Beliefs: True, False Or Nuanced | Seeking Alpha REITs have a higher dividend yield than the S&P, so the duration of REITs is lower in the same way that the duration of a 30 year coupon bond is shorter than a 30 year zero coupon bond. Based on...

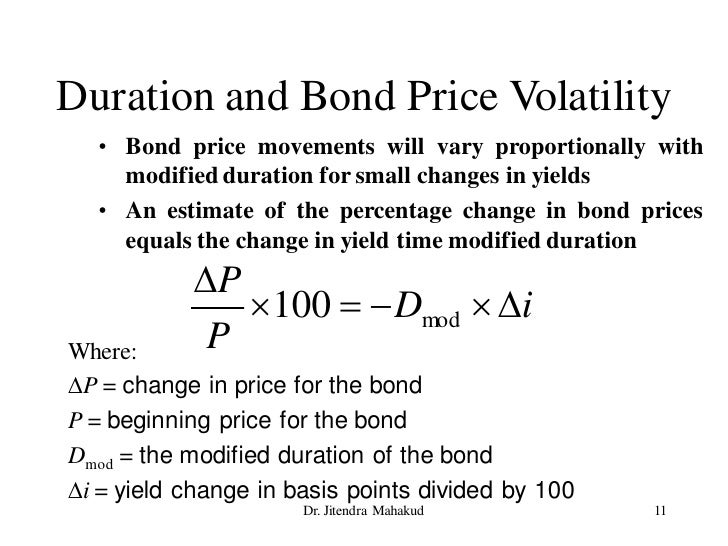

Gold Q3 2022 Forecast: Fundamental Outlook Weakens Gold behaves, in effect, like a long duration asset (as measured by modified duration, not Macaulay duration); a zero-coupon bond. Gold Futures vs. US Treasury Nominal, Real Yields and US Break ...

Bonds Calculators - appspot.com Zero-Coupon Bonds. Given: Face Value, Bond Price, Yield to Maturity To Find: Time. Face Value is $ Bond Price is $ Yield to Maturity is in Calculate. Given: Face Value, Bond Price, Time To Find: Yield to Maturity. Face Value is $ Bond Price is $ Time is in ...

Bond Discounting Problems and Solutions - Accountancy Knowledge Problem 10: ABC is Public Limited Company. The company board of director was decided to offer 1,000 no. of bonds of par value of $10 each in 2004; carrying 15 percent coupon rate and 5 year maturity period, bond would mature in 2009. The discount rate in first year (2005) was 10 percent. The rate was same in 2006.

Active, Index & Smart Beta Exchange Traded Funds (ETFs) | PIMCO The 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund was rated against the following numbers of Long Government funds over the following time periods: 1 stars out of 30 funds overall; 1 stars out of 30 funds in the last three years, 1 stars out of 27 funds in the last five years, and 1 star out of 21 funds in the last ten years.

What Are Bonds and How Do They Work? - The Balance Zero-coupon bonds: Bonds that do not pay interest during the life of the bonds. Instead, investors buy zero-coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond matures. Convertible bonds: Can be converted into a different security—typically shares of the same company's common ...

What is a Coupon Value? Definition and Calculation A zero-coupon rate bond does not pay an annual coupon rate It has longer maturity dates and greater volatility but sells for a discount An entity sells a 20-year zero-coupon rate bond at $5,000 The investor earns no interest during the 20 years but receives $30,000 at the maturity date

Post a Comment for "44 duration for zero coupon bond"