43 ytm for coupon bond

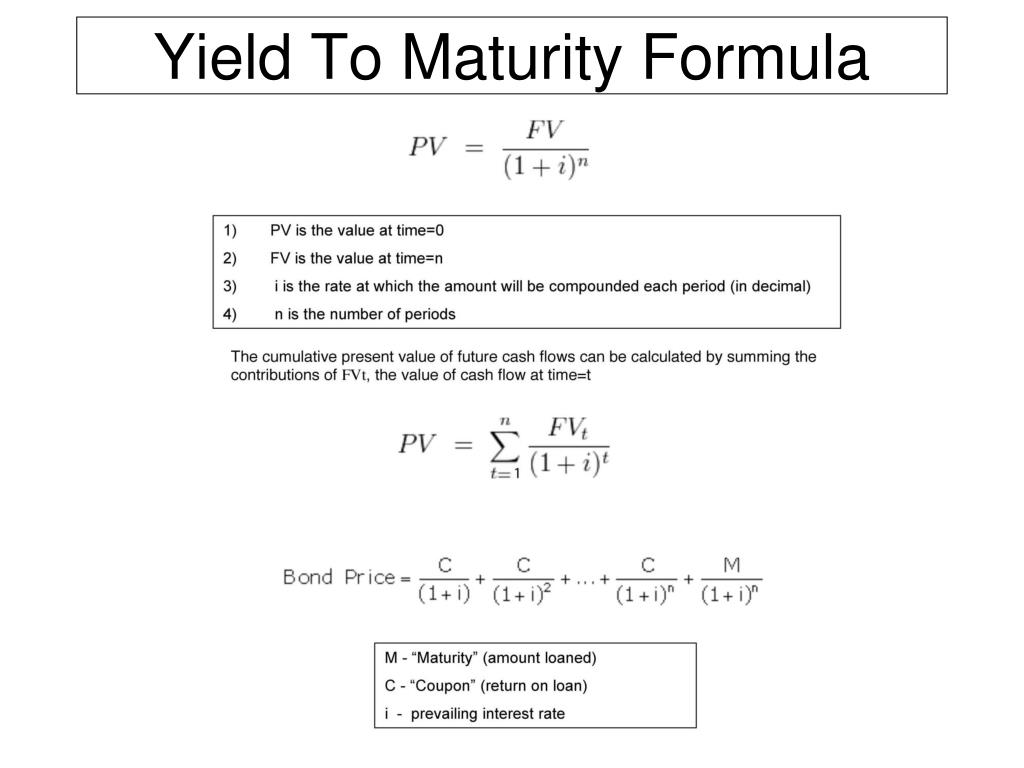

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity Calculator Inputs. Current Bond Trading Price ($) - The price the bond trades at today. Bond Face Value/Par Value ($) - The face value of the bond, also known as the par value of the bond. Years to Maturity - The numbers of years until bond maturity.; Bond YTM Calculator Outputs. Yield to Maturity (%): The converged upon solution for the yield to maturity of the … dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

› bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price.

Ytm for coupon bond

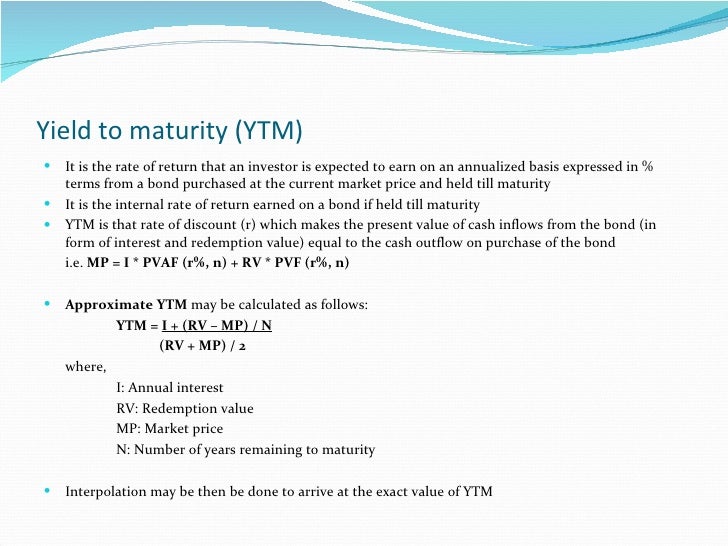

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/(1.1) 30 = 5.73). Over the coming 30 years, the price will advance to $100, and the annualized return will be 10%. What happens in the meantime? Yield to Maturity (YTM) Definition - Investopedia 31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , … Yield to Maturity (YTM): Formula and Excel Calculator - Wall … What is the Yield to Maturity (YTM)? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made …

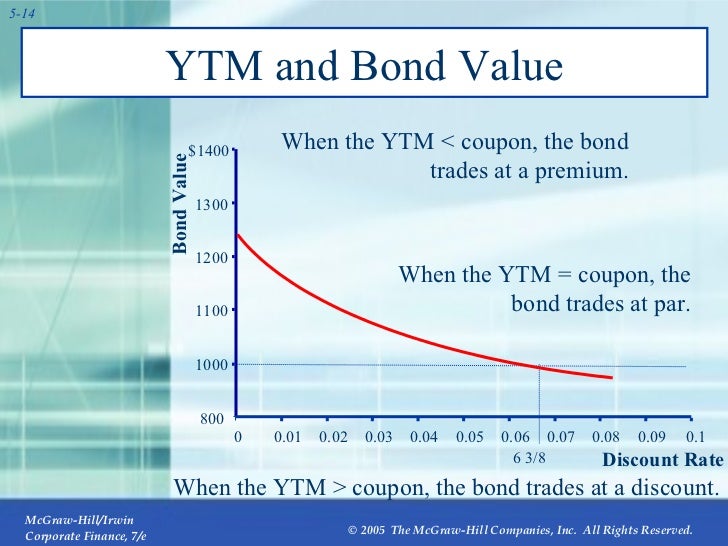

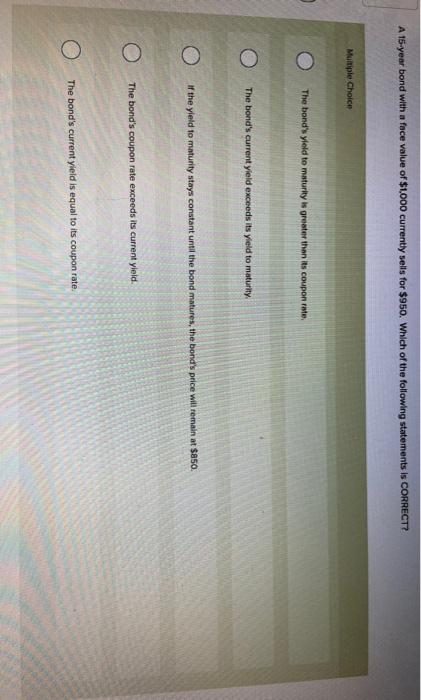

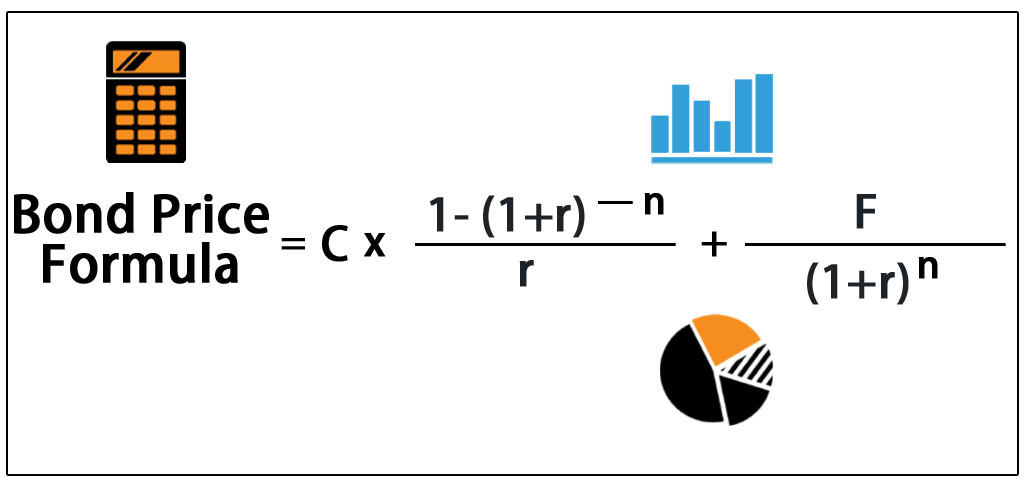

Ytm for coupon bond. › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. Yield to Maturity Calculator | Calculate YTM 14.07.2022 · The n for Bond A is 10 years. Calculate the YTM; The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM, the bond price is less than the face value, and as … Yield to maturity - Wikipedia If a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, then the bond is selling at par. Variants of yield to maturity. As some bonds have different characteristics, there are some variants of YTM: Yield to call (YTC): when a bond is callable (can be repurchased by the issuer before the maturity), the market …

Bond Price Calculator | Formula | Chart 20.06.2022 · coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Bond Yield Calculator - Moneychimp Coupon Rate: % Years to Maturity: Results: Current Yield: % Yield to Maturity: % Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and current yield. Compound Interest Present Value Return Rate / CAGR Annuity Pres. Val. of … Bond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price. It completely ignores the time ... › calculator › bond_yield_calculatorBond Yield Calculator - Moneychimp Coupon Rate: % Years to Maturity: Results ... Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and current yield.

› terms › yYield to Maturity (YTM) Definition - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › yield-to-maturity-ytmYield to Maturity (YTM): Formula and Excel Calculator In comparison, the current yield on a bond is the annual coupon income divided by the current price of the bond security. An important distinction between a bond’s YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Bond Pricer & YTM Calculator – Calculate Bond Prices and Yields … A bond that pays a fixed coupon will see its bond price vary inversely with interest rates. This is because bond prices are intrinsically linked to the interest rate environment in which they trade for example - receiving a fixed interest rate, of say 8% is not very attractive if prevailing interest rates are 9% and become even less desirable if rates move up to 10%. In order for that bond ... Yield to Maturity (YTM): Formula and Excel Calculator - Wall … What is the Yield to Maturity (YTM)? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made …

Yield to Maturity (YTM) Definition - Investopedia 31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , …

en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/(1.1) 30 = 5.73). Over the coming 30 years, the price will advance to $100, and the annualized return will be 10%. What happens in the meantime?

Post a Comment for "43 ytm for coupon bond"