42 coupon vs zero coupon bonds

› knowledge › yield-toYield to Maturity (YTM): Formula and Calculator (Step-by-Step) Annual Coupon Rate (%) = 6.0%; Number of Years to Maturity = 10 Years; Price of Bond (PV) = $1,050; We’ll also assume that the bond issues semi-annual coupon payments. Given those inputs, the next step is to calculate the semi-annual coupon rate, which we can calculate by dividing the annual coupon rate by two. home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

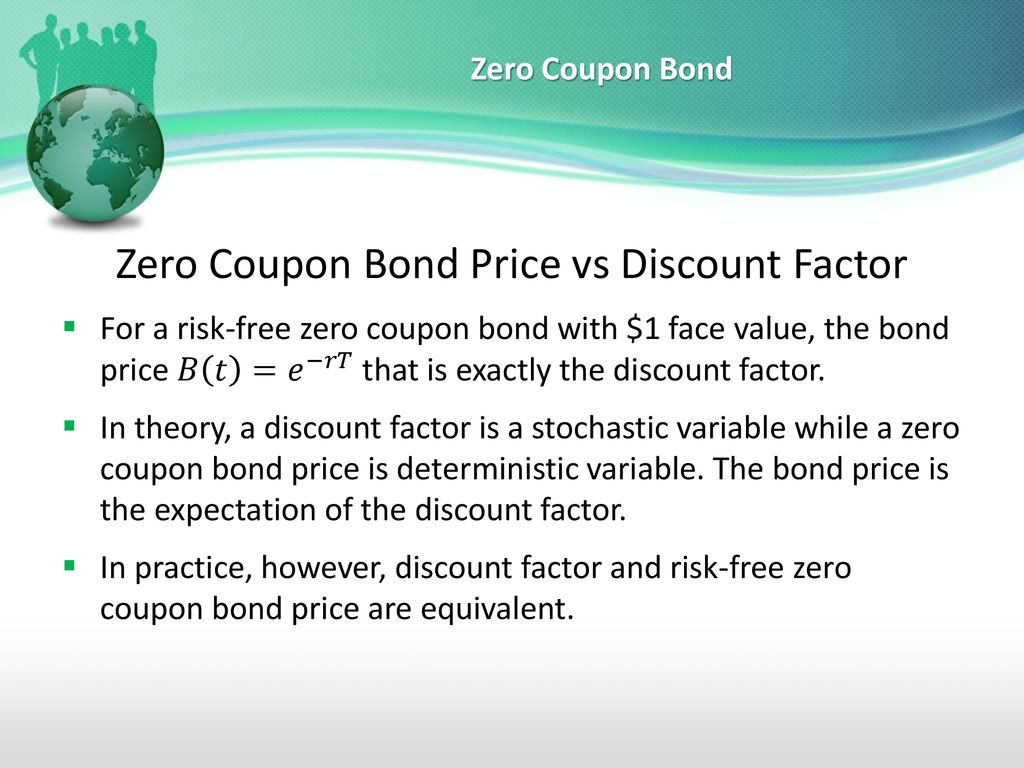

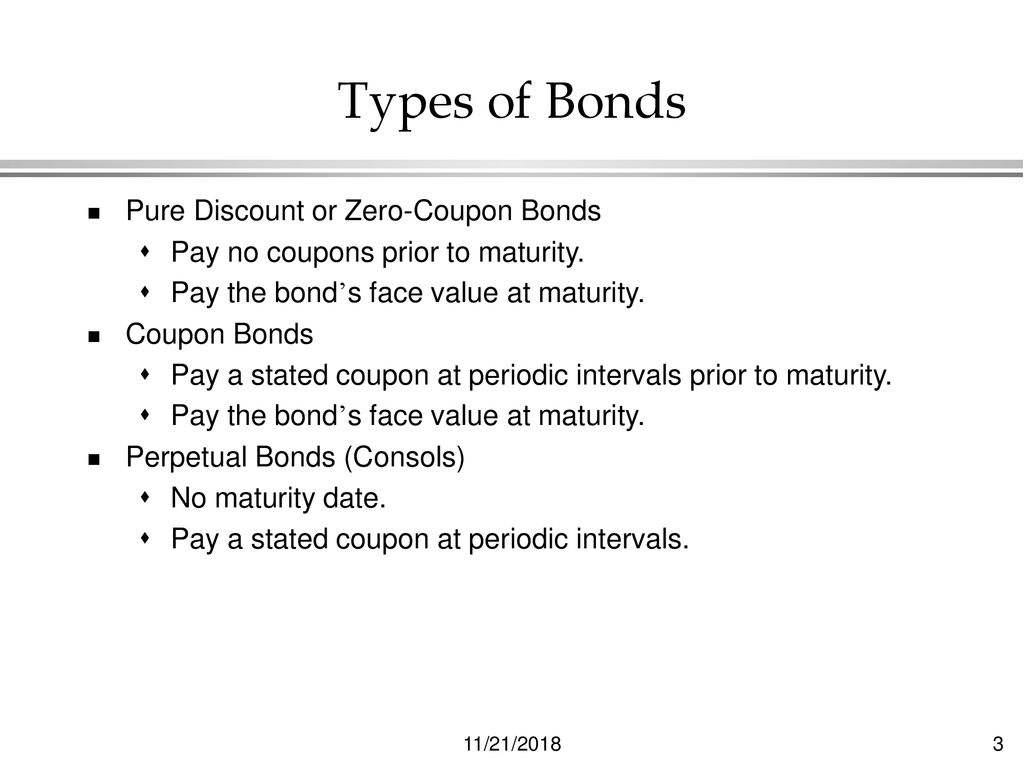

Coupon vs zero coupon bonds

› articles › investingSimple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia Sep 29, 2022 · As noted, most corporate bonds pay out semiannually; however, the alternatives are annually or quarterly: a corporate bond (annual coupon frequency) with a $1,000 face value and a fixed 6% coupon ... › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Coupon vs zero coupon bonds. en.wikipedia.org › wiki › ArbitrageArbitrage - Wikipedia Investor longs the zero-coupon bonds making up the related yield curve and strips and sells any coupon payments at t 1. As t>t 1, the price spread between the prices will decrease. At maturity, the prices will converge and be equal. Investor exits both the long and short positions, realising a profit. › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › articles › investingSimple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia Sep 29, 2022 · As noted, most corporate bonds pay out semiannually; however, the alternatives are annually or quarterly: a corporate bond (annual coupon frequency) with a $1,000 face value and a fixed 6% coupon ...

/GettyImages-1169665828-e5e668e6aa454b60b5d06e110711eff3.jpg)

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

Post a Comment for "42 coupon vs zero coupon bonds"