40 what is the duration of a zero coupon bond

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 · John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20.

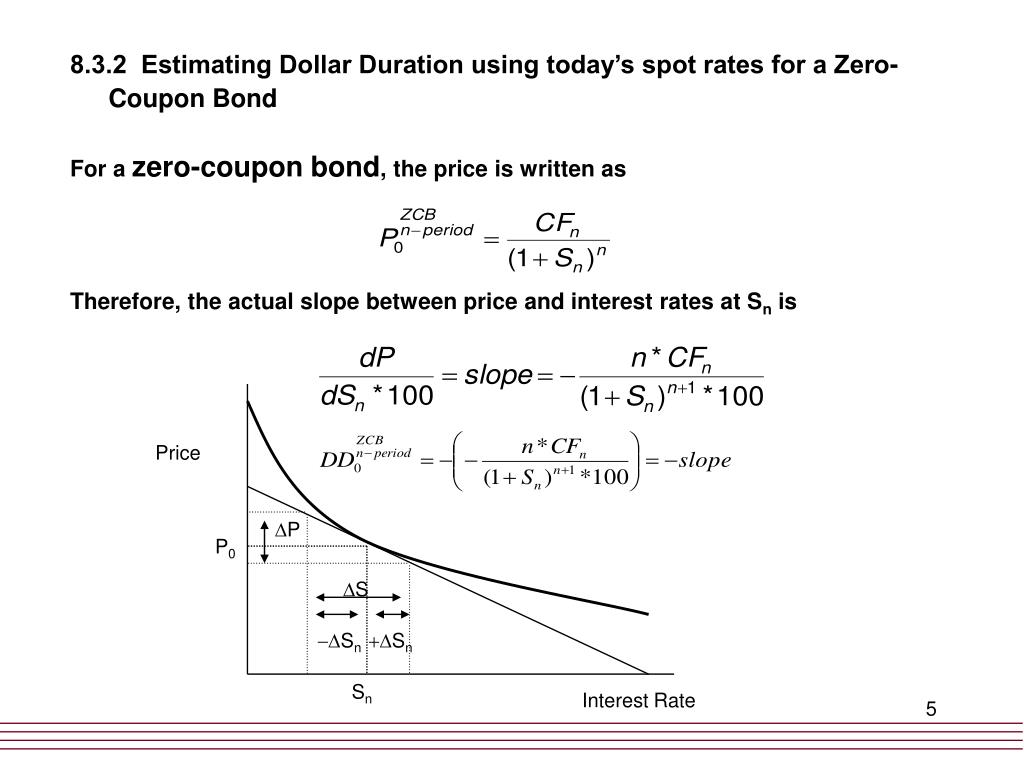

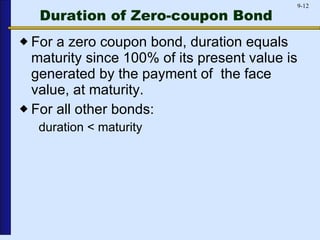

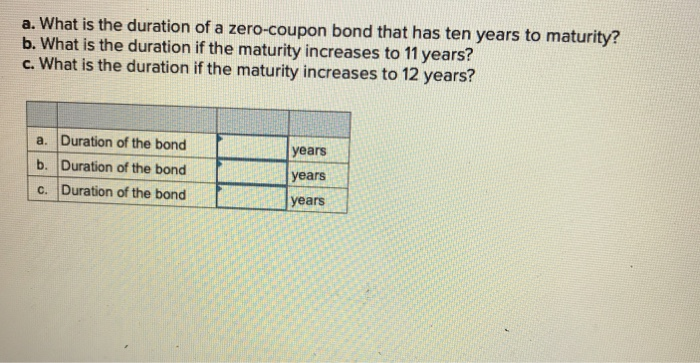

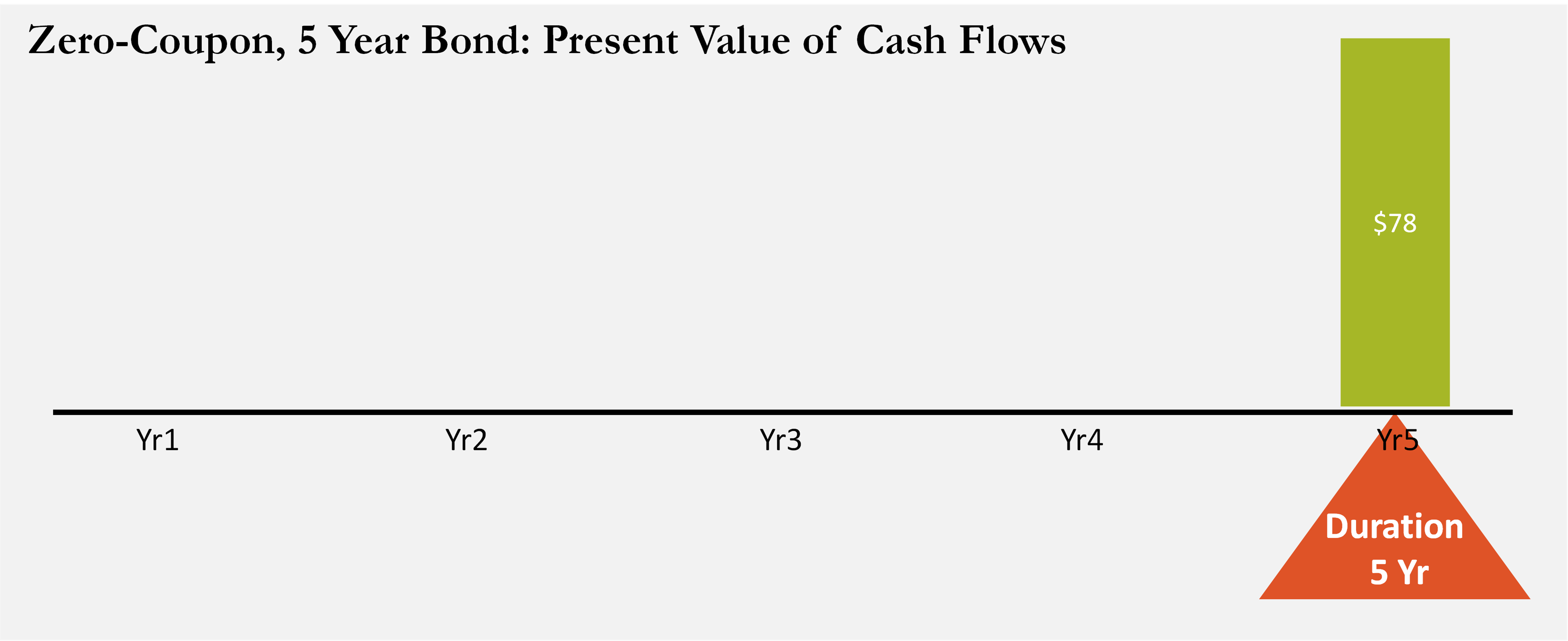

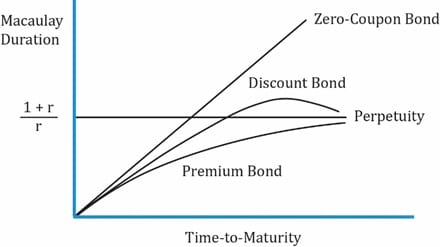

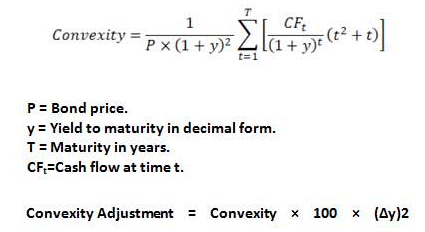

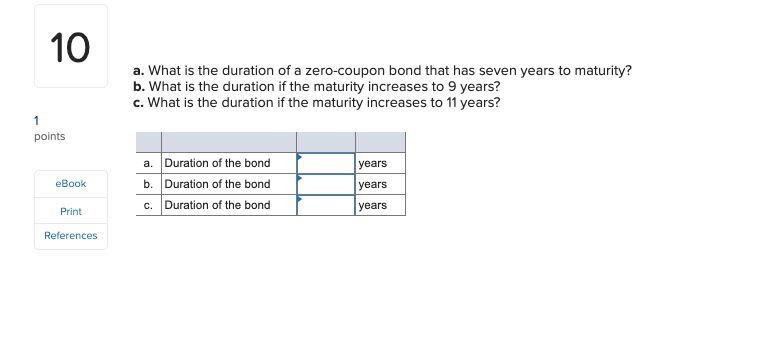

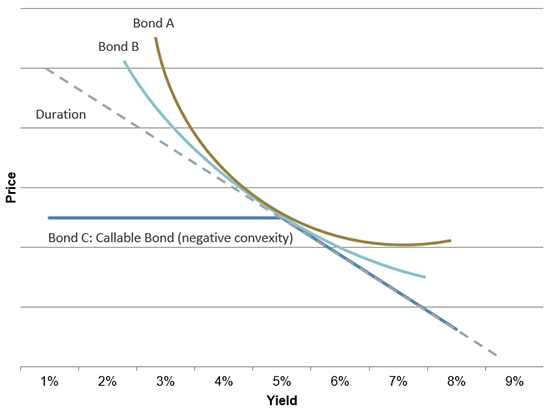

Bond Duration Calculator – Macaulay and Modified Duration From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity – it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

What is the duration of a zero coupon bond

What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child’s college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

What is the duration of a zero coupon bond. The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount. Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child’s college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

Post a Comment for "40 what is the duration of a zero coupon bond"